Picky Agent Saves Buyer Money – Okaloosa Island – Destin, FL

They say salespeople are not detail oriented. Well, they should be. My picky OCD personality has helped…

They say salespeople are not detail oriented. Well, they should be. My picky OCD personality has helped…

If you don’t think land sale scams happen on 30A, in Walton County, Florida, think again! Listen to…

I’m about to list a waterfront lot in Walton County, Florida. It’s on a rare Coastal Dune Lake. …

I’ve seen it happen again and again. A buyer is out-of-state and has their eye on a piece…

As the listing agent of a home Bluewater Bay, Florida, I was recently asked this question by a…

I recently had a Destin Florida home listed where the seller accepted a contract contingent on the buyer’s…

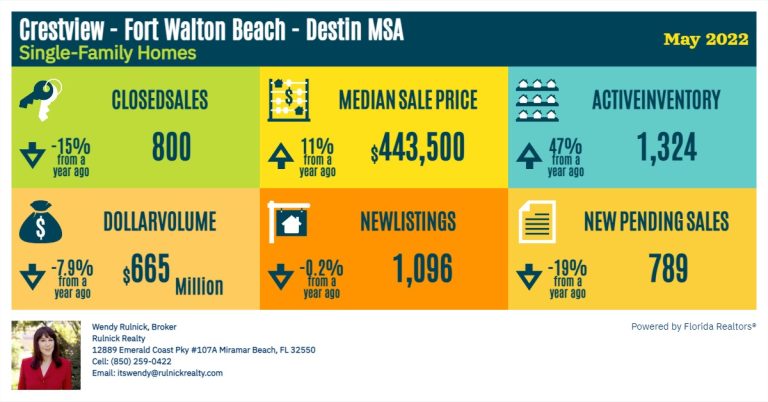

Crestview – Fort Walton Beach – Destin MSA May 2022 Closed Sales 800. -15% from a year ago….

One common mistake in writing an offer in this competitive market, or any real estate market, is that…

Recently I’ve had two situations near Destin Florida where a real estate buyer’s agent would not provide their…

People who buy and sell Destin Florida residential real estate are generally emotional. I don’t blame them. So…